michigan sales tax exemption for farmers

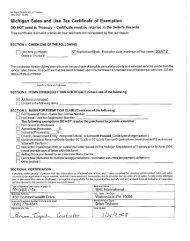

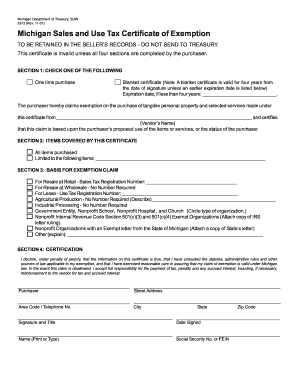

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Use tax is a companion tax to sales tax.

Michigan Sales Tax Guide For Businesses

Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use.

. Streamlined Sales and Use Tax Project. Without the bills officials who havent kept pace will continue enforcing nebulous. How do I get a farm sales tax exempt in Michigan.

Provides a sales and use tax exemption for farm products sold at farmers markets. For transactions occurring on and after October 1 2015 an out-of-state seller may be. For most agricultural retailers this.

Drainage tile and portable grain bins are two items that can be exempt from sales tax. Agricultural property in Michigan is taxed at 50 percent above the national average which is a significant cost. Michigan provides an exemption from sales or use tax on tangible personal property used in tilling planting caring for or harvesting things of the soil in the breeding raising or caring of.

Farms are defined as any place from which. You should never use your social security number for retail purchases. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into.

Several examples of exemptions to the. There is no such thing as a Sales Tax Exemption Number for agriculture. When purchasing sales tax exempt agricultural items in Michigan you must sign a certificate stating that the item is for agricultural production.

Its why farmers need House Bill 4561 and 4564 to bring the state department up to speed. Sales Tax Return for Special Events. There is no such thing as a Sales Tax Exemption Number for agriculture.

Michigan Sales and Use Tax Contractor Eligibility Statement. Items such as building supplies for attached structures are not exempt. Farms are defined as any place from which.

Requirements for the Michigan Agriculture Exemption for Sales Tax Farm Ownership. Agricultural Land Value Grid. Farmers across the state can breathe a little easier after Lieutenant Governor Brian Calley signed into law legislation to protect agricultures sales and use tax exemptions and put.

Notice of New Sales Tax Requirements for Out-of-State Sellers. Lowering agricultural property taxes in Michigan. The exemption does not apply to farm products sold by persons or entities with sales of at least.

Sales Tax Exemptions in Michigan In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Michigan Sales and Use Tax Certificate of Exemption. A farm is defined by USDA as a place where over 1000 in.

You should never use your social security number for retail purchases. Only farm owners qualify for the exemption. Claim for Farmland Qualified Agricultural Exemption for Some School Operating Taxes.

Getting Sales Taxes Up To Speed Michigan Farm News

Tangible Personal Property State Tangible Personal Property Taxes

Sales And Use Tax Regulations Article 3

How To Register For A Sales Tax Permit In Michigan Taxvalet

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

Getting Sales Taxes Up To Speed Michigan Farm News

Generational Transfer Tax Law Changes Could You Be Impacted Michigan Farm News

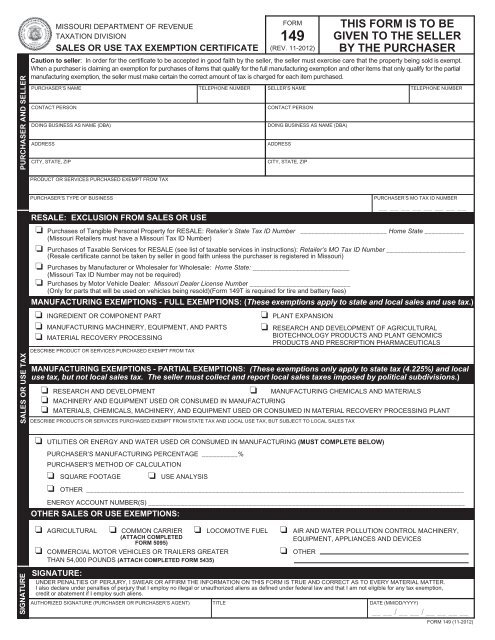

Form 149 Sales And Use Tax Exemption Certificate Missouri

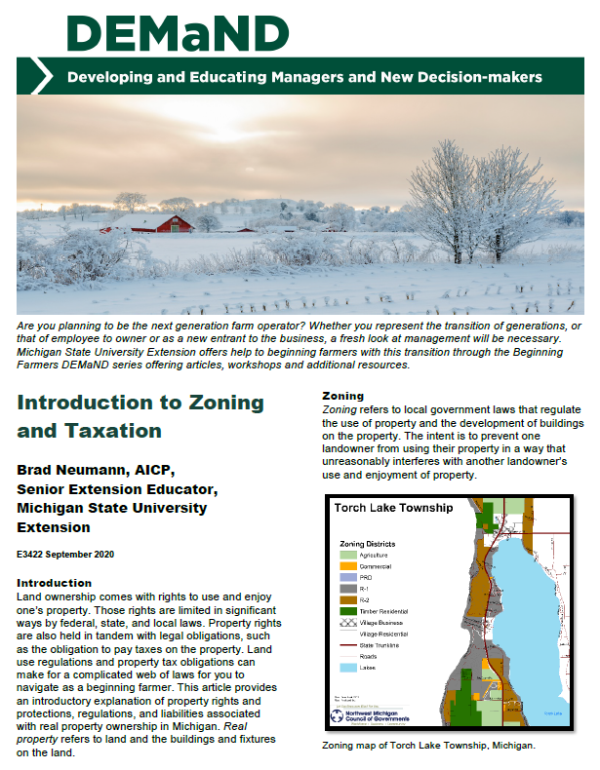

Bulletin E 3422 Introduction To Zoning And Taxation Farm Management

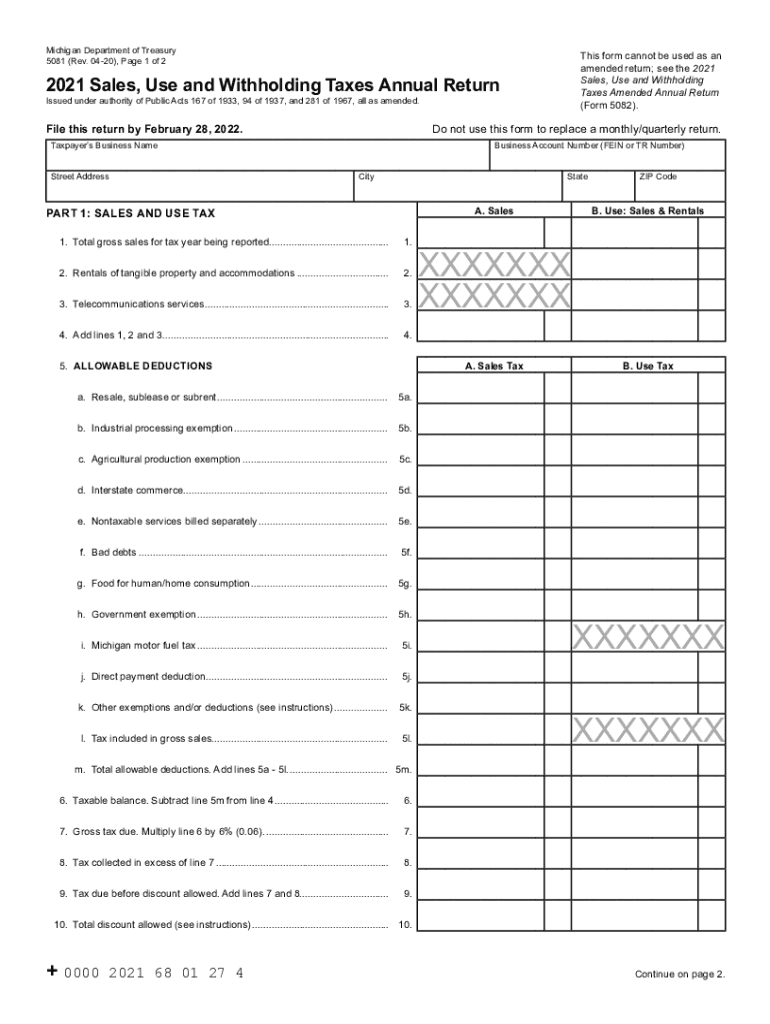

Form 5081 Fill Out Sign Online Dochub

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Sales And Use Tax Regulations Article 3

Michigan Tax Considerations For Alternative Energy Producers Varnum Llp

Michigan Real Estate Sales Tax Determination Of Property S Taxability

Missouri Sales Tax Exemption For Agriculture Agile Consulting

Resale Certificate Michigan Form Fill Out And Sign Printable Pdf Template Signnow